How We Do It

Plan Testing and Your Critical Path

Stress Testing Your Retirement Plan Against Reality

Many affluent households approach retirement with significant assets but little clarity on whether those resources will truly support their lifestyle for 30 years or more. Net worth alone does not equal retirement readiness. You might enter retirement with several million dollars, but if your lifestyle requires high annual spending, early withdrawals, or ongoing obligations for children, parents, or health needs, the margin for error narrows quickly.

That is why we stress test your retirement plan from multiple directions. Instead of assuming markets will cooperate or that average returns will show up in a straight line, we examine how your plan performs under conditions that often derail even well-funded retirees.

These tests help you answer essential questions:

- Can you maintain your lifestyle all the way through retirement?

- What if you live longer than expected—age 95, 100, or beyond?

- How would your plan respond to a severe market downturn early in retirement?

- What if inflation stays elevated or healthcare costs spike?

- How would long-term care expenses affect your security?

This disciplined approach helps reveal vulnerabilities early so we can adjust your strategy long before they become problems.

Three Ways We Pressure-Test Your Retirement

Monte Carlo Testing

Monte Carlo testing analyzes thousands of potential market sequences to determine how often your retirement plan succeeds. Instead of relying on straight-line average returns, it models real-world volatility and randomness. You see how your plan holds up in strong markets, flat markets, and historically difficult periods.

We use this tool to measure the probability of success for your retirement income plan and to identify whether changes in withdrawals, spending, or portfolio construction can improve your long-term results. The visual meters make it easy to understand the likelihood of sustaining your lifestyle without running out of money.

Your Critical Path Analysis

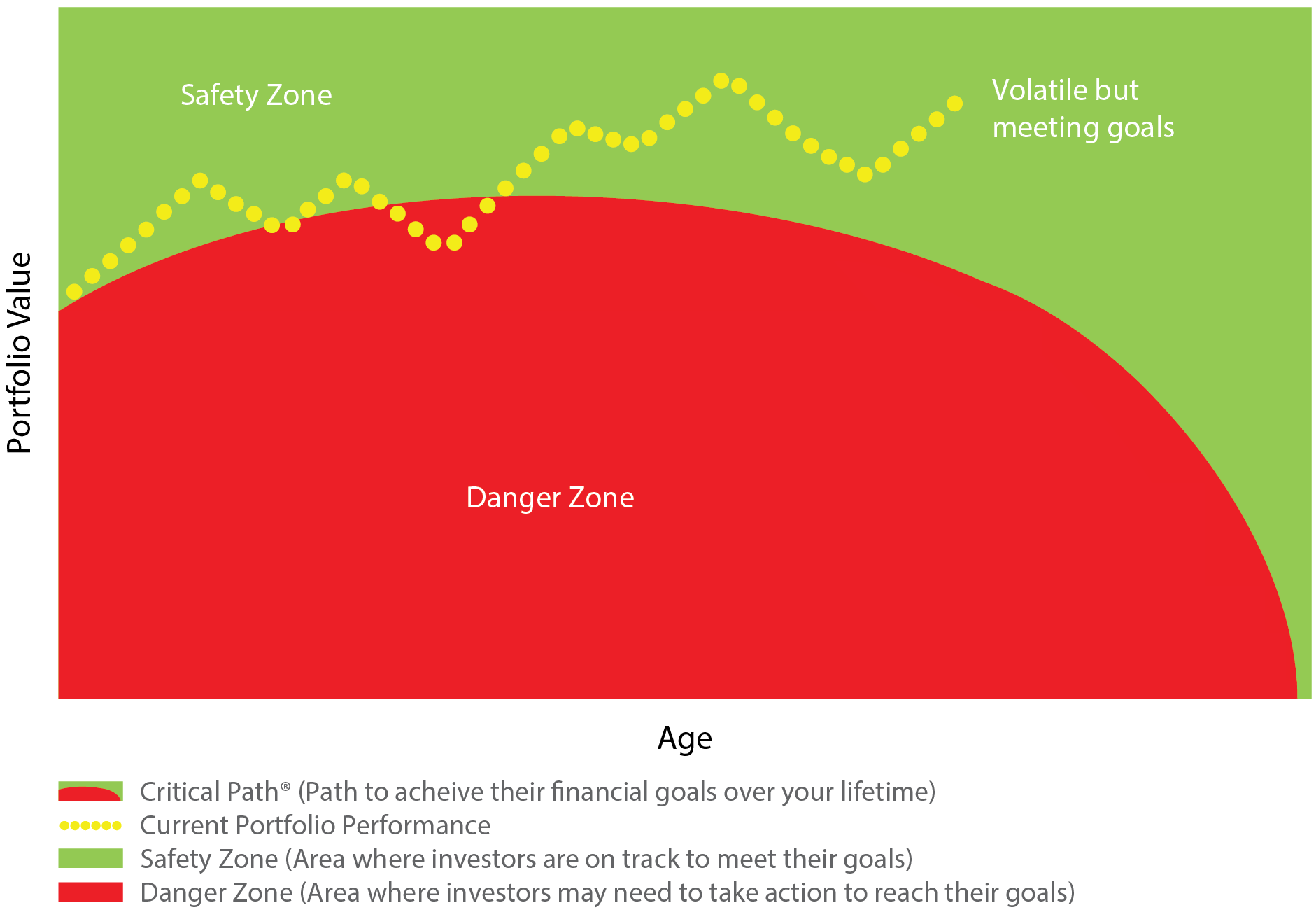

The Critical Path system provides a clear, year-by-year roadmap of how your retirement income strategy should progress. It tracks whether you are above, on, or below the trajectory required for long-term security.

Think of it as a financial navigation system. If markets decline early in retirement, the Critical Path shows the impact immediately and helps determine whether adjustments are needed. If your path stays stable, you gain added confidence knowing you are still aligned with your long-term goals.

Funded Ratio Testing

The funded ratio measures how well your current assets and income sources match your projected lifetime spending needs. It compares what you have against what you will need—similar to how pensions and endowments assess long-term sustainability.

A funded ratio of 100% or more indicates your retirement is fully supported under current assumptions. A lower ratio highlights areas where spending, savings, or investment strategy may need refinement. This test is especially valuable for high-net-worth retirees whose withdrawals will be substantial.