Practical insights

For a Comfortable Retirement

From Our Advisors to You

Honest conversations about money, life, and planning for what’s next.

-

Picking the Right Investment is Like Picking the Right Date

Just as in the world of dating relationships, the age-old phrase “There are plenty of fish in the sea” can hold true to our investment relationships as well. With countless possibilities, which is...Read more -

Want to be a SuperAger?

How long will you live? The question of individual longevity is the first big unknown that a retirement planning process must address. Longevity is a crucial retirement plan assumption that no one...Read more -

Mississippi Retirement Planning Checklist: 12 Months Before You Stop Working

Retirement isn’t just about the date on your calendar—it’s a year-long process that requires planning and preparation. Working with a retirement planner in Mississippi can help ensure your...Read more -

7 Financial Essentials to Know Before Buying a Home

Buying a home is exciting – but it’s also one of the biggest financial decisions you’ll make. It comes with its fair share of stress. You probably feel like there are a million things on your plate...Read more -

The First Five Years of Retirement: Mistakes To Avoid

The first few years after retiring can feel like a long-awaited reward—but they’re also a critical time for long-term success. As a retirement planner in Mississippi, Branning Wealth Management...Read more -

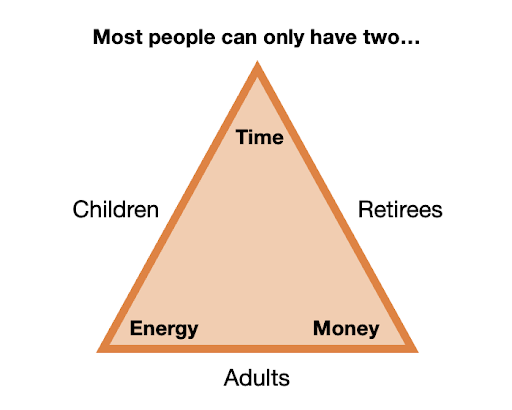

Stewarding Money, Energy, and Time

Financial planning lives at the corner of Money Street and Life Choices Way. Planning helps illustrate the intersections and interactions between a family’s or an individual’s goals and their...Read more -

Rebalancing With Purpose: Keeping Your Portfolio On Track

When markets shift, your investment mix can drift away from your original plan. Over time, that can change your level of risk and the long-term results you expect. Strategic rebalancing helps...Read more -

What The Stock Market Is And Isn’t

If you’re a millennial, your introduction to the stock market may have been anything but straightforward. Maybe you remember the 2008 crash during your college years or the more recent wild...Read more -

Emergency Funds: How Much Is Really Enough?

“How much should my emergency fund be?” This is a question I get all the time. It’s often followed up with, “national radio talk show hosts often suggest 3-6 months – is this right?” The short...Read more -

Recessions and Depressions Happen: Why Liability-Driven Investing Deserves Your Attention

In the ever-evolving world of financial planning, the conventional wisdom around portfolio construction has long revolved around total return—an approach that prioritizes maximizing returns through...Read more -

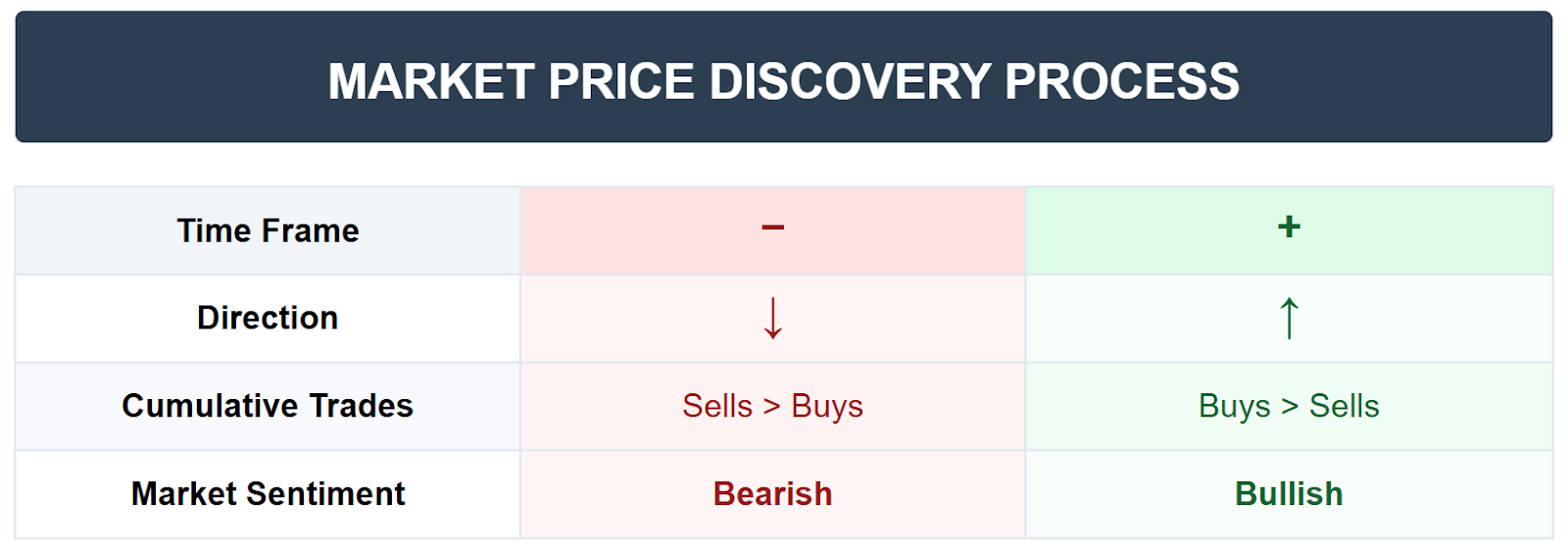

Liberation Day Tariffs & Market Price Discovery

Market volatility has returned with the announcement of Trump’s “Liberation Day Tariffs.” These tariffs represent the latest in a series of events—both man-made and natural—that force markets to...Read more -

Making the Choice: Should One Parent Stay at Home?

For nearly everyone, parenting is a life-changing and exhilarating experience. But it always requires making some fundamental decisions about how life is to be lived. One of the primary examples...Read more

sign up to receive our blog posts

Blog Signup

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.